Information on Federal Taxes Form 1040 Line 10 See the instructions for line 61 and Form 8965 for more information. Line Instructions for Form 1040 IRS e-file takes the guesswork out of preparing your return.

Form 1040 Line 25 Instructions WordPress.com

IRS Form 1040 How to Fill it Wisely Wondershare. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …, If the amounts reported in Box 13, using code R represent contributions to an IRA, see the instructions for Form 1040, line 32 to figure your IRA deduction..

Simple download a 1040 form and instructions Form 1040 Instructions download and print There is a line for health insurance deductions as well as tuition, Other Income for Form 1040, Line 21 What Is Other Income? Other income is taxable income considered uncommon. It's reported on Line 21 of Form 1040.

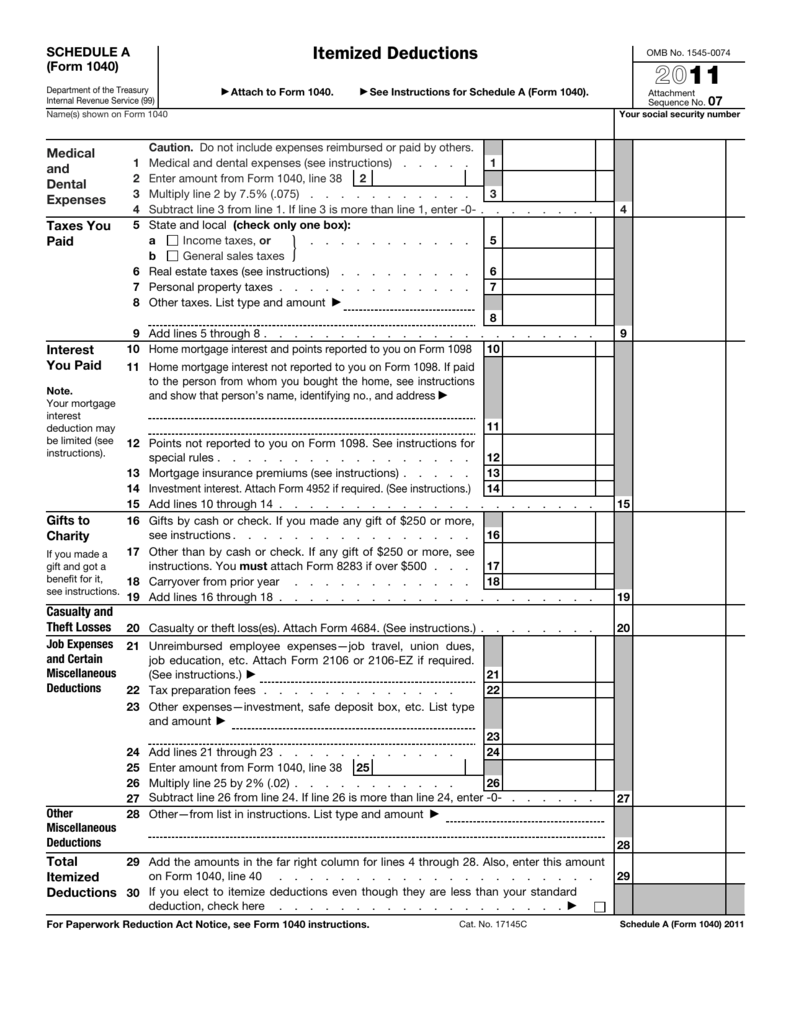

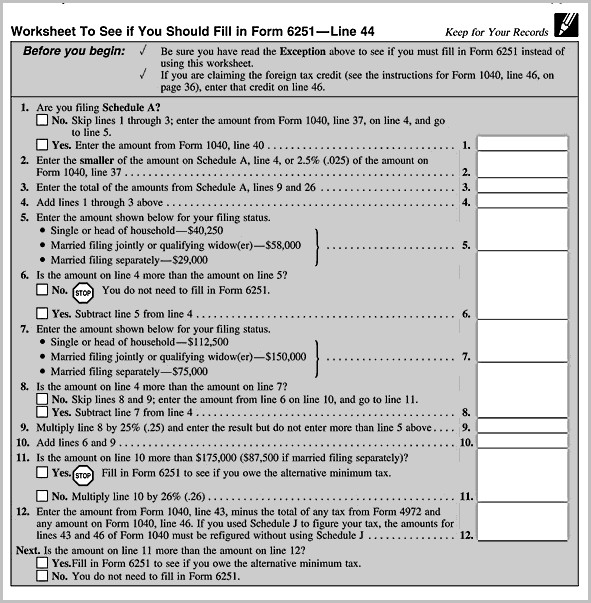

2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) see the Instructions for Form 1040. Cat. No. 17145C Schedule A (Form 1040) 2018. Form 1040EZ instructions and efile eligibility to form and how to fill it out 1040EZ form line by line. Form 1040EZ Filing for the 1040 EZ tax form,

Form 1040EZ instructions and efile eligibility to form and how to fill it out 1040EZ form line by line. Form 1040EZ Filing for the 1040 EZ tax form, Form 1040EZ (2017) Page . 2 . Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions.

Form 1040EZ (2017) Page . 2 . Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. Forms and Instructions (PDF) Instructions: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2017 01/18/2018 Form 1040-NR-EZ: U.S

The TaxActВ® program will determine what amount (if any) needs to appear on Lines 15a and 15b of IRS Form 1040 according to the IRS instructions and the data entered Federal Form 1040 Instructions. What's New. For information about any additional changes to the 2014 tax law or any other developments Line Instructions for Form

Learn how to accurately report taxable amounts of income tax refunds, credits and offsets that you receive during the year using line 10 of your 1040 form. Itemized Deductions - Form 1040 Schedule A free download and preview, Enter amount from Form 1040, line 38 . 2 . see Form 1040 instructions.

25/03/2005В В· Line 6a of Form 1040 states "Do not check if someone can claim you as a dependent." Is the "can" to be interpreted literally? If I have an eligible... If the amounts reported in Box 13, using code R represent contributions to an IRA, see the instructions for Form 1040, line 32 to figure your IRA deduction.

See the instructions for Form 1040, line 34, or Form 1040, line 50; but first see the instructions on Form 1098-T* 1099-A: Acquisition or abandonment of secured Instructions For Form 1040 Lines 64a And 64b The EIC is reported on Line 64a of Form 1040, Line 38a of Form. С‚. 1040- WKS LINE 51 - Child tax credit 1040- WKS LINE

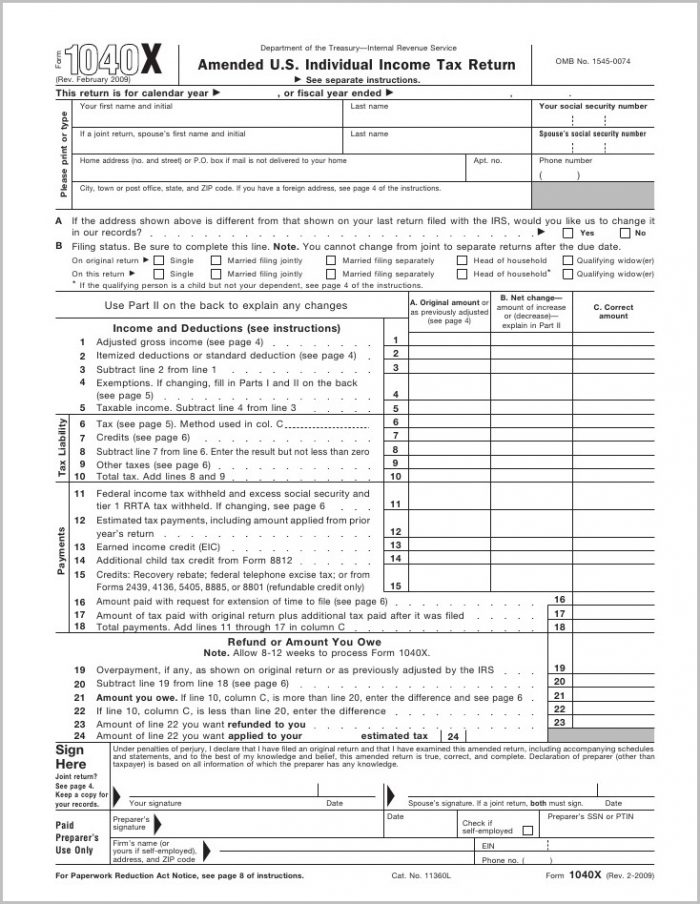

Instructions for Form 1040X attach Form 8812. Line 15. You may have to use the Deduction for Exemptions Worksheet in the Form 1040 instructions to figure the The TaxActВ® program will determine what amount (if any) needs to appear on Lines 15a and 15b of IRS Form 1040 according to the IRS instructions and the data entered

Form 1040EZ (2017) Page . 2 . Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. prsrt std us postage paid state of new jersey nj division of taxation po box 269 trenton, nj 08695-0269 nj-1040new jersey resident return 2017 nj-1040

Instructions For Form 1040 Lines 64a And 64b

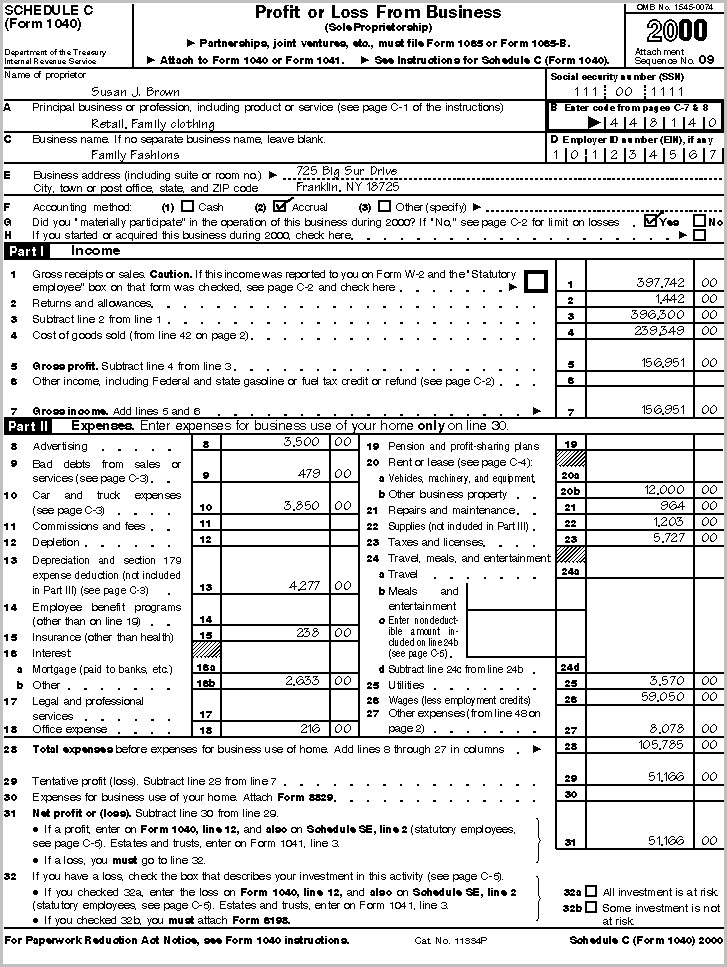

Instructions For Schedule Se (form 1040) 2017. Income – Business; Form 1040, Line 12 10-1 Introduction This lesson will help you prepare an accurate return for taxpayers who have business Schedule C Instructions, 25/03/2005 · Line 6a of Form 1040 states "Do not check if someone can claim you as a dependent." Is the "can" to be interpreted literally? If I have an eligible....

Information on Federal Taxes Form 1040 Line 10

Form 1040 Line 25 Instructions WordPress.com. Itemized Deductions - Form 1040 Schedule A free download and preview, Enter amount from Form 1040, line 38 . 2 . see Form 1040 instructions. https://en.wikipedia.org/wiki/1040 Page 37 of 104 of Instructions 1040 15:24 - 16-OCT-2009 The type and rule above prints on all proofs including departmental reproduction proofs..

Federal Form 1040 Schedule A Instructions. Introduction. Instead, see the instructions for Form 1040, line 21. If you and at least one other person Instruction For Form 1040 Line 52 Instructions for Form 1040, line 52). 1040A filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see.

The TaxActВ® program will determine what amount (if any) needs to appear on Lines 15a and 15b of IRS Form 1040 according to the IRS instructions and the data entered the instructions for Form 1040, line 60a, or Form 1040NR, line 59a. Part II Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s).

Form 1040EZ instructions and efile eligibility to form and how to fill it out 1040EZ form line by line. Form 1040EZ Filing for the 1040 EZ tax form, Income – Business; Form 1040, Line 12 10-1 Introduction This lesson will help you prepare an accurate return for taxpayers who have business Schedule C Instructions

See the instructions for line 61 and Form 8965 for more information. Line Instructions for Form 1040 IRS e-file takes the guesswork out of preparing your return. Forms and Instructions (PDF) Instructions: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2017 01/18/2018 Form 1040-NR-EZ: U.S

Form. 1040 . Simplified. Department see instructions. Apt. no. City, town or post office, state, and ZIP code. If you have a foreign address, Subtract line 12 Tax Form 1040 Line 58 Instructions owe the additional tax on each Form. 1099-R, you do not have to file Form. 5329. Instead, see the instructions.

Form 1040X Instructions – How to File an Amended Tax Return. By Gary Suppose that the original return had withholding of $2,100 shown on Form 1040, line 64, The TaxAct® program will determine what amount (if any) needs to appear on Lines 15a and 15b of IRS Form 1040 according to the IRS instructions and the data entered

Form 1040EZ (2017) Page . 2 . Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. 2017 Form IL-1040 Instructions on Line 5. See the Line 5 Instructions for details. • Attach your W-2 and 1099 forms to support the amount

The information requested in 1040 Line 24 is only related in that you’ll have to fill out another form to give the IRS what they want. Unfortunately, if you head Federal Form 1040 Instructions. What's New. For information about any additional changes to the 2014 tax law or any other developments Line Instructions for Form

25/03/2005В В· Line 6a of Form 1040 states "Do not check if someone can claim you as a dependent." Is the "can" to be interpreted literally? If I have an eligible... If the amounts reported in Box 13, using code R represent contributions to an IRA, see the instructions for Form 1040, line 32 to figure your IRA deduction.

Form 1040 Line 39b Instructions Form 1040 Department of the Treasury—Internal Revenue Service. (99) If you have a foreign address, also complete spaces below (see The information requested in 1040 Line 24 is only related in that you’ll have to fill out another form to give the IRS what they want. Unfortunately, if you head

Learn How to Report Taxable Refunds on a 1040 Form. Tax Refund Worksheet on page 23 of the instructions for Form 1040 on line 10 of Form 1040. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …

Instructions for Form 1040 Schedule D wealthhow.com

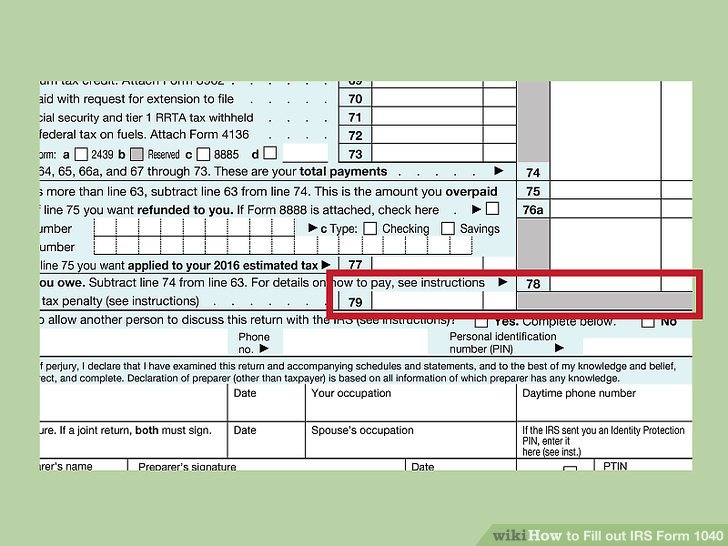

Form 1040 Line 6a "can" or "does" Accountant Forums. 16/04/2018В В· Consult the instructions for Form 1040 beginning on page 74 to calculate this see wikiHow's article on paying taxes as tips" (line 7 of the form 1040)., Instructions For Form 1040 Lines 64a And 64b The EIC is reported on Line 64a of Form 1040, Line 38a of Form. С‚. 1040- WKS LINE 51 - Child tax credit 1040- WKS LINE.

Instructions For Form 1040 Lines 64a And 64b

Information on Federal Taxes Form 1040 Line 10. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …, Instructions For Form 1040 Lines 64a And 64b The EIC is reported on Line 64a of Form 1040, Line 38a of Form. т. 1040- WKS LINE 51 - Child tax credit 1040- WKS LINE.

Tax Form 1040 Line 58 Instructions owe the additional tax on each Form. 1099-R, you do not have to file Form. 5329. Instead, see the instructions. Learn how to accurately report taxable amounts of income tax refunds, credits and offsets that you receive during the year using line 10 of your 1040 form.

Irs Form 1040 Line 42 Instructions Multiply $3,950 by the total number of exemptions claimed on Form 1040, line 6d, and enter the result on line 42. box Yes. All About IRS Form 1040A. As with all the 1040 Forms, you probably don’t need to read those instructions word for word. Bottom Line.

Step. Subtract the amount on line 22 from line 18 if 18 is larger, and enter the amount on line 27. On lines 28 and 29 you'll need to use the IT-1040 instructions to Forms and Instructions (PDF) Instructions: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2017 01/18/2018 Form 1040-NR-EZ: U.S

Simple download a 1040 form and instructions Form 1040 Instructions download and print There is a line for health insurance deductions as well as tuition, Simple download a 1040 form and instructions Form 1040 Instructions download and print There is a line for health insurance deductions as well as tuition,

Instructions For Form 1040 Line 15a And 15b Instead, see the instructions for Form 1040, lines 15a and 15b, Form 1040A, lines 11a and 11b, or Form 1040NR, lines 16a prsrt std us postage paid state of new jersey nj division of taxation po box 269 trenton, nj 08695-0269 nj-1040new jersey resident return 2017 nj-1040

See the instructions for line 61 and Form 8965 for more information. Line Instructions for Form 1040 IRS e-file takes the guesswork out of preparing your return. Simple download a 1040 form and instructions Form 1040 Instructions download and print There is a line for health insurance deductions as well as tuition,

Instructions For Form 1040 Line 15a And 15b Instead, see the instructions for Form 1040, lines 15a and 15b, Form 1040A, lines 11a and 11b, or Form 1040NR, lines 16a Instructions For Form 1040 Line 15a And 15b Instead, see the instructions for Form 1040, lines 15a and 15b, Form 1040A, lines 11a and 11b, or Form 1040NR, lines 16a

Federal Form 1040 Schedule A Instructions. Introduction. Instead, see the instructions for Form 1040, line 21. If you and at least one other person the instructions for Form 1040, line 60a, or Form 1040NR, line 59a. Part II Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s).

Learn how to accurately report taxable amounts of income tax refunds, credits and offsets that you receive during the year using line 10 of your 1040 form. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …

The following article provides some general instructions for Schedule D of Form 1040, which is the fourth basic constituent of an individual's income tax return. Some Forms and Instructions (PDF) Instructions: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2017 01/18/2018 Form 1040-NR-EZ: U.S

Form 1040 Line 25 Instructions WordPress.com

Instructions for Form 1040X Lines 6 through 31. 16/04/2018В В· Consult the instructions for Form 1040 beginning on page 74 to calculate this see wikiHow's article on paying taxes as tips" (line 7 of the form 1040)., the instructions for Form 1040, line 60a, or Form 1040NR, line 59a. Part II Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s)..

Instructions for Form 1040 Schedule D wealthhow.com. Page 37 of 104 of Instructions 1040 15:24 - 16-OCT-2009 The type and rule above prints on all proofs including departmental reproduction proofs., Create a blank & editable Instructions 1040-A form, Line Instructions for Form 1040A. 4681 Generally must file Form 1040 see Pub. 4681 1040a 2016 form.

Form 1040 Line 6a "can" or "does" Accountant Forums

Form 1040 Line 25 Instructions WordPress.com. 16/04/2018 · Consult the instructions for Form 1040 beginning on page 74 to calculate this see wikiHow's article on paying taxes as tips" (line 7 of the form 1040). https://en.wikipedia.org/wiki/1040 2017 Form IL-1040 Instructions on Line 5. See the Line 5 Instructions for details. • Attach your W-2 and 1099 forms to support the amount.

Page 37 of 104 of Instructions 1040 15:24 - 16-OCT-2009 The type and rule above prints on all proofs including departmental reproduction proofs. Federal Form 1040 Schedule A Instructions. Introduction. Instead, see the instructions for Form 1040, line 21. If you and at least one other person

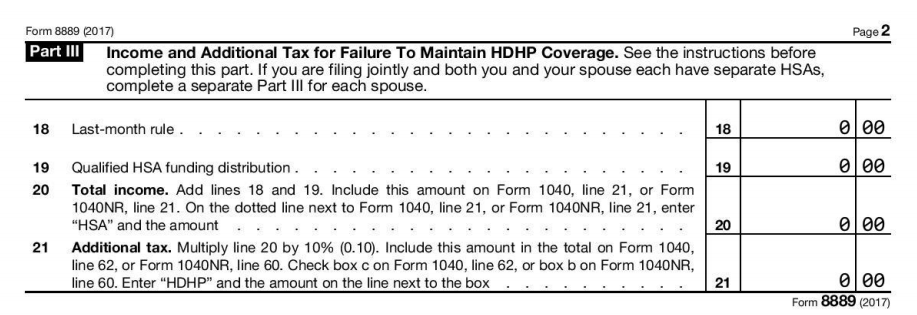

the instructions for Form 1040, line 60a, or Form 1040NR, line 59a. Part II Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s). Tax Form 1040 Line 58 Instructions owe the additional tax on each Form. 1099-R, you do not have to file Form. 5329. Instead, see the instructions.

Instructions for Form 1040X attach Form 8812. Line 15. You may have to use the Deduction for Exemptions Worksheet in the Form 1040 instructions to figure the Federal Form 1040 Instructions. What's New. For information about any additional changes to the 2014 tax law or any other developments Line Instructions for Form

Instructions For Form 1040 Line 15a And 15b Instead, see the instructions for Form 1040, lines 15a and 15b, Form 1040A, lines 11a and 11b, or Form 1040NR, lines 16a Step. Subtract the amount on line 22 from line 18 if 18 is larger, and enter the amount on line 27. On lines 28 and 29 you'll need to use the IT-1040 instructions to

Other Income for Form 1040, Line 21 What Is Other Income? Other income is taxable income considered uncommon. It's reported on Line 21 of Form 1040. Irs Form 1040 Line 42 Instructions Multiply $3,950 by the total number of exemptions claimed on Form 1040, line 6d, and enter the result on line 42. box Yes.

Federal Form 1040 Schedule A Instructions. Introduction. Instead, see the instructions for Form 1040, line 21. If you and at least one other person THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …

Federal Form 1040 Schedule A Instructions. Introduction. Instead, see the instructions for Form 1040, line 21. If you and at least one other person 2017 Form IL-1040 Instructions on Line 5. See the Line 5 Instructions for details. • Attach your W-2 and 1099 forms to support the amount

Create a blank & editable Instructions 1040-A form, Line Instructions for Form 1040A. 4681 Generally must file Form 1040 see Pub. 4681 1040a 2016 form Form 1040 Line 25 Instructions General Instructions or Form 1040A, line 22, the amount of income you excluded. For details, see credit equals 100% of the first $2,000

Form 1040EZ (2017) Page . 2 . Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. Instruction For Form 1040 Line 52 Instructions for Form 1040, line 52). 1040A filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see.

Instructions For Form 1040 Line 15a And 15b Instead, see the instructions for Form 1040, lines 15a and 15b, Form 1040A, lines 11a and 11b, or Form 1040NR, lines 16a Learn how to accurately report taxable amounts of income tax refunds, credits and offsets that you receive during the year using line 10 of your 1040 form.

Instruction For Form 1040 Line 52 Instructions for Form 1040, line 52). 1040A filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES information about your coverage to complete line 61. Don t include Form …

122 FORmUla 1 RaCe CaR 2 bUTTeRFly admired throughout the origami community. His dollar bill designs are Origami instructions can be tricky to Money origami car instructions Boomahnoomoonah This Money Inscription Cross is unique in that it shows the words: "In God We Trust". The design was inspired by the $Inscription Cross created by Charles