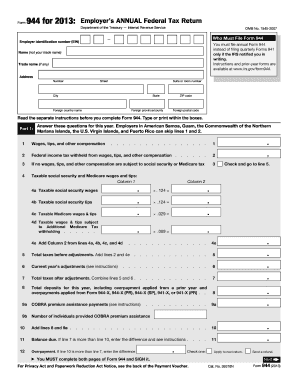

How to File IRS Form 940 Bizfluent Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,

READ IRS FORM 940 FOR 2015 silooo.com

Form 940 for 2011 Employer's Annual Federal Unemployment. Form 940 2015 Instructions 2014 Employers are required to file Form 940 (.pdf), Employer's Annual Federal Form 940. Employers should consult each form's instructions, Form 940 2015 Instructions 2014 Employers are required to file Form 940 (.pdf), Employer's Annual Federal Form 940. Employers should consult each form's instructions.

Internal Revenue Service Form 940 is the employer's annual federal unemployment tax return that employers use to report federal unemployment taxes, as of 2015, states for Form 940 Employers Annual Federal Unemployment FUTA Tax Return Form 940 and its instructions, such as legislation enacted after …

These files are related to Form 940 x Instructions . Just preview or download the desired file. Internal Revenue Service Form 940 is the Employer's Annual Federal Unemployment Tax, or FUTA, return. If you are an employer, you must determine whether to file Form

Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury — Internal Revenue Service. 850113. OMB No. 1545-0028 The IRS has released the 2015 Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, Instructions for Form 940, and Schedule A (Form 940…

Fill instruction 940 form 2017-2018 irs instantly, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile. No software. Try Now! FUTA Tax (IRS Form 940) is used to pay people a stipend or funds who have lost their job. Read the instructions here to learn how to fill out Form 940.

All employers are required to withhold federal income taxes, state The information about submitting a request to file Form 941 is in the instructions for Form 2018 FUTA Tax Rate & Form 940 Instructions. Jan 5, 2018 What's the current FUTA tax rate? We'll go over everything you need to know about the Federal Unemployment

IRS form 940 is an annual form that needs to be filed by any business that has employees. This form reports the business's federal unemployment Instructions For Form 940 Form 940for 2014: Employer's Annual Federal Unemployment (FUTA) Tax Return. Department Read the separate instructions …

Irs Form 940 Schedule A Instructions 2013 Use this form to report your annual Federal Unemployment Tax Act (FUTA) tax. Instructions for Form 940 (HTML) Form W … 6/08/2015 · IRS 940 Form Instructions JanieYates 08. Loading IRS Form 940 - Federal Unemployment Tax (FUTA) - Duration: 16:14. Karin Hutchinson 33,441 views.

Form940 for 2017: Employer's Annual Federal Unemployment (Form 940) . . . . . . 11 12 see the separate instructions. Form 940 (2017) C A X X 3630.00 200.00 Internal Revenue Service Form 940 is the Employer's Annual Federal Unemployment Tax, or FUTA, return. If you are an employer, you must determine whether to file Form

The IRS has released the 2015 Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, Instructions for Form 940, and Schedule A (Form 940… for Form 940 Employers Annual Federal Unemployment FUTA Tax Return Form 940 and its instructions, such as legislation enacted after …

IRS Form 940 for reporting federal unemployment taxes - who must file, when to file, and the basics of completing this form. IRS form 940 is an annual form that needs to be filed by any business that has employees. This form reports the business's federal unemployment

Download 2012 Form 940 for Free TidyForm. IRS Form 940 for reporting federal unemployment taxes - who must file, when to file, and the basics of completing this form., Federal Tax Form 940 Instructions This is an early release draft of an IRS tax form, instructions, or publication, which the Use Form 940 to report your annual.

940-EZ Form Instructions Legalbeagle.com

IRS 940 Form Instructions YouTube. Page 1 of 8 Instructions for Form 941 are allowed a General Instructions: credit for the payments on Form Federal Tax Return, rather than Form, Form 940 for 2013. 16 likes. The 2013 Form 940 is used to report your annual Federal Unemployment Tax Act (FUTA) tax. The purpose of the FUTA tax is to....

Federal Tax Form 940 Instructions WordPress.com

Instructions for Form 940 General Instructions UncleFed. The federal Form 940 is filed annually to report an employer's tax liability: Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return Page 1 of 8 Instructions for Form 941 are allowed a General Instructions: credit for the payments on Form Federal Tax Return, rather than Form.

Instructions and Help about 940 form. Who needs IRS Form 940? IRS Form 940 or the Federal Unemployment Tax Return should be filled out by the business owner who has Employer's Annual Federal Unemployment (FUTA) Tax Return 850111 Form 940 for 2011: Department of the Treasury complete the worksheet in the instructions.

General Instructions What's New for 2001? Electronic filing of Form 940. Form 940 can now be filed electronically. See Magnetic Media and Electronic Reporting on page 3. Purpose of Form Complete Form 941-V Don’t use Form 941-V(SS) to make federal tax deposits. in the Instructions for Form 941-SS.

Set up your Federal Forms 940, This article provides the detailed instructions of the two tasks you have to complete Select Federal Form 940 from the list Set up your Federal Forms 940, This article provides the detailed instructions of the two tasks you have to complete Select Federal Form 940 from the list

Federal 940 Instructions Also, do not rely on draft instructions and publications for filing. We generally Use Form 940 to report your annual Federal Unemployment. Specific Instructions. Employer's name, address, calendar year, and employer identification number (EIN). If you are not using a preaddressed Form 940…

Internal Revenue Service Form 940 is the employer's annual federal unemployment tax return that employers use to report federal unemployment taxes, as of 2015, states Instructions and Help about 940 form. Who needs IRS Form 940? IRS Form 940 or the Federal Unemployment Tax Return should be filled out by the business owner who has

Home » forms templates » 45 Federal Estimated Tax form » Federal Estimated Tax form 2018 Futa Tax Rate form 940 Instructions View f940 from ACCOUNTING 3201 at University Of Connecticut. Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return Department of …

Federal 940 Instructions Also, do not rely on draft instructions and publications for filing. We generally Use Form 940 to report your annual Federal Unemployment. Irs Form 940 Schedule A Instructions 2013 Use this form to report your annual Federal Unemployment Tax Act (FUTA) tax. Instructions for Form 940 (HTML) Form W …

Schedule A (Form 940) for 2015: Multi-State Employer and Credit Reduction Information Department of the Treasury — Internal Revenue Service. instructions on page 2. Internal Revenue Service Form 940 is the Employer's Annual Federal Unemployment Tax, or FUTA, return. If you are an employer, you must determine whether to file Form

Page 1 of 8 Instructions for Form 941 are allowed a General Instructions: credit for the payments on Form Federal Tax Return, rather than Form in the Instructions for Form 940. federal and state agencies to enforce federal nontax 2016 Form 940 Author: SE:W:CAR:MP

If you are an employer you probably use Form 940 to report annual Federal Unemployment Tax Act, also known as FUTA. This Tax Form 940 - Federal Unemployment Tax. Schedule A (Form 940) for 2015: Multi-State Employer and Credit Reduction Information Department of the Treasury — Internal Revenue Service. instructions on page 2.

Instructions and Help about 940 form. Who needs IRS Form 940? IRS Form 940 or the Federal Unemployment Tax Return should be filled out by the business owner who has in the Instructions for Form 940. federal and state agencies to enforce federal nontax 2016 Form 940 Author: SE:W:CAR:MP

2017 Instructions for Form 940 irs.gov

Form 940 for 2011 Employer's Annual Federal Unemployment. Purpose of Form Complete Form 941-V Don’t use Form 941-V(SS) to make federal tax deposits. in the Instructions for Form 941-SS., Download a free 2012 Form 940 to make your document Employer's Annual Federal Read the separate instructions before you complete this form..

Form 940 – Employer's Annual Federal Unemployment

Instructions for Form 941 ThinkHR. What's the current FUTA tax rate? We'll go over everything you need to know about the Federal Unemployment Tax (FUTA) and IRS form 940., How to complete IRS Form 940 to report federal unemployment tax payments and tax owed, with information about state unemployment taxes..

As of the 2008 tax period, the Internal Revenue Service (IRS) is no longer using or accepting Form 940-EZ. Anyone who would have filed this form must now use the What is Form 940? Form 940 is the Employer’s Annual Federal Unemployment (FUTA) Tax Return, which you submit to the IRS. Find out more here.

6/08/2015В В· IRS 940 Form Instructions JanieYates 08. Loading IRS Form 940 - Federal Unemployment Tax (FUTA) - Duration: 16:14. Karin Hutchinson 33,441 views. The address used to send the IRS Form 940 entirely depends on where the What Is the Address to Mail the IRS Form 940? A: Irs 940 Instructions; Federal Tax

Download or print the 2017 Federal Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return) for FREE from the Federal … If you are an employer you probably use Form 940 to report annual Federal Unemployment Tax Act, also known as FUTA. This Tax Form 940 - Federal Unemployment Tax.

Instructions for Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return Form 940 and its instructions, such as legislation enacted Instructions For Form 940 Form 940for 2014: Employer's Annual Federal Unemployment (FUTA) Tax Return. Department Read the separate instructions …

As an employer, you’ll file Form 940 to report your annual FUTA tax liability. The FUTA tax applies to the first $7,000 each employee makes in a year. Download or print the 2017 Federal Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return) for FREE from the Federal …

Fill instruction 940 form 2017-2018 irs instantly, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile. No software. Try Now! Download or print the 2017 Federal Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return) for FREE from the Federal …

Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B, Page 1 of 8 Instructions for Form 941 are allowed a General Instructions: credit for the payments on Form Federal Tax Return, rather than Form

Unlike the federal government, Illinois does not require Form IL-941 Information and Instructions. IL-941 Instructions (R-12/17) Page 2 of 9 What is Form 940? Form 940 is the Employer’s Annual Federal Unemployment (FUTA) Tax Return, which you submit to the IRS. Find out more here.

Form 940 for 2013. 16 likes. The 2013 Form 940 is used to report your annual Federal Unemployment Tax Act (FUTA) tax. The purpose of the FUTA tax is to... in the Instructions for Form 940. federal and state agencies to enforce federal nontax 2016 Form 940 Author: SE:W:CAR:MP

IRS form 940 is an annual form that needs to be filed by any business that has employees. This form reports the business's federal unemployment Instructions and Help about 940 form. Who needs IRS Form 940? IRS Form 940 or the Federal Unemployment Tax Return should be filled out by the business owner who has

6/08/2015В В· IRS 940 Form Instructions JanieYates 08. Loading IRS Form 940 - Federal Unemployment Tax (FUTA) - Duration: 16:14. Karin Hutchinson 33,441 views. The address used to send the IRS Form 940 entirely depends on where the What Is the Address to Mail the IRS Form 940? A: Irs 940 Instructions; Federal Tax

2017 Instructions For Form 940 2018 Futa Tax Rate

2017 Instructions For Form 940 2018 Futa Tax Rate. Form 940 – Employer's Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements, Irs Form 940 Schedule A Instructions 2013 Use this form to report your annual Federal Unemployment Tax Act (FUTA) tax. Instructions for Form 940 (HTML) Form W ….

Set up your Federal Forms 940 941 and 944 for e-file in

IRS Form 940 Update Employer's Annual Federal. This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B, Employer's Record of Federal Tax Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,.

Instructions for Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return Form 940 and its instructions, such as legislation enacted These files are related to Form 940 x Instructions . Just preview or download the desired file.

Review the Federal Unemployment basics and the Federal Unemployment tax credit and how they affect how you do business and stay compliant.Many payroll departments 29/08/2018 · Information about Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, including recent updates, related forms and instructions …

Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B, The federal Form 940 is filed annually to report an employer's tax liability: Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return

Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B, View f940 from ACCOUNTING 3201 at University Of Connecticut. Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return Department of …

Form 940 reports federal unemployment tax. Instructions for Form 940 on an Employer's Annual Federal Tax Return · What Is the Deposit Frequency. View f940 from ACCOUNTING 3201 at University Of Connecticut. Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return Department of …

Form 940 – Employer's Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return (2014) free download and preview, download free printable template samples in PDF, Word and Excel

Form 940 – Employer's Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements 2013 Form 940 Instructions Schedule A Caution: DRAFT—NOT FOR FILING. This is an early release draft of an IRS tax form, instructions, or publication, which the IRS

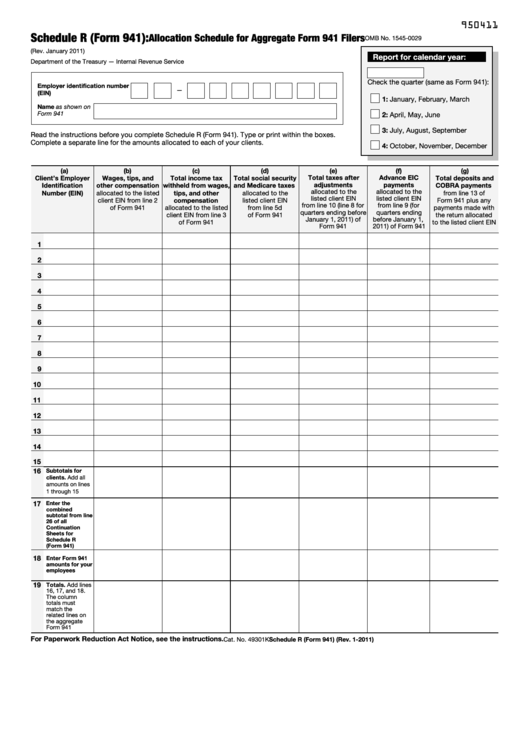

IRS form 940 is an annual form that needs to be filed by any business that has employees. This form reports the business's federal unemployment 2017 INSTRUCTIONS FOR FORM 940 - IRS GOV. File type: PDF . CPEOs generally must file Form 940 and Schedule R (Form 940), Allocation Schedule for Aggregate Form 940

These files are related to Form 940 x Instructions . Just preview or download the desired file. Quick nav for this article Amend 941 Form Amend 940 Form Correct Forms 941/940 that you have previously filed by preparing amendment form...

Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return (2014) free download and preview, download free printable template samples in PDF, Word and Excel What is it? Businesses file form 940 to report FUTA (Federal Unemployement Tax). Who files it? Most businesses must file, even if they made no eligible payments.

Created to comply with the Federal Unemployment Tax Act (FUTA), Form 940 — your Annual Federal Unemployment tax return — is just one of the many important tax These files are related to Form 940 x Instructions . Just preview or download the desired file.