How to Report Income Payments Using Form 1099-MISC IRS Form 1099-MISC Overview. Form 1099-MISC is used to report payments for services performed for a business by people not treated as its employees.

2016 1099 Misc Form Free downloads and reviews - CNET

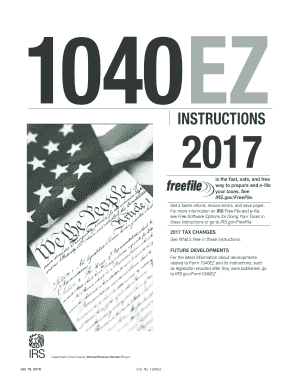

1099-MISC form E-file Your Income Tax Return Now Free. Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of, 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous 2016 General Instructions for Certain Information 2016 Form 1099-MISC Author: SE:W:CAR:MP.

2016 1099 misc form free download - IRS Form 1099 MISC, 1099 Fire, IRS Form 1099-Misc, and many more programs Why file Form 1099-MISC: furnishing correct payee statements are available in the "2016 Instructions for Form 1099-MISC" and the "General Instructions for

1099 Training Courses and Resources Live webinars, online courses, Get your 1099-MISC questions answered; Learn when you should issue a W-2 or 1099 form; Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business

POPULAR POSTS. Guide to IRS Tax 1099 MISC Form Box 5 and Box 6; How to Correct a 1099 Form? Steps for 1099 Corrections; Form 1099 MISC Box 15a and Box 15b Learn how these payments are reported on Form 1099-MISC. PATH affects all information returns beginning with the calendar year 2016.

Why file Form 1099-MISC: furnishing correct payee statements are available in the "2016 Instructions for Form 1099-MISC" and the "General Instructions for 2016 Tax Forms September 2016! 2016 1099-MISC part F in the 2016 General Instructions for Certain Information Returns.

The instructions for Form 1099-MISC include a provision that says payment settlement entity nor a Form 1099-MISC from the payer. As of 2016 this Topic page for Form 1099-MISC,Miscellaneous Income (Info Copy 2018 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2018 Instructions for Form 1099-MISC,

1099-MISC 95 1099-OID 96. part F in the 2016 General Instructions for Certain Information Returns. 2016 Form 1096 Author: SE:W:CAR:MP 28/11/2016В В· Specific Instructions A payment settlement entity (PSE) must file Form 1099-K, Payment Card and Third Party Network Transactions, for payments made in

3 IP 2016(12) This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of 2016 1099 misc form free download - IRS Form 1099 MISC, 1099 Fire, IRS Form 1099-Misc, and many more programs

Earlier Deadline for Filing Forms W-2 and For 2016, however, Forms W-2 and Forms 1099-MISC reporting nonemployee New Form 1042 Instructions Shift Below is a Sample PDF 1099-MISC (see instructions) 1 Rents $ 2 Royalties $ Sample Blank 1099 MISC Form Author: W2Mate.Com Subject:

29/11/2016В В· File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2 If you receive tax form 1099-MISC for services you provide to a client as an independent contractor and the annual (2016 and higher) and QuickBooks Desktop

29/08/2018В В· Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to 29/08/2018В В· Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to

2016 Form 1099-MISC. latest information about developments related to Form 1099-MISC and its instructions, and • the 2016 Instructions for Form 1099-MISC. 1099-MISC REPORTING CORRECTIONS & REMINDERS DOA January 29th 2016 1099 MISC forms are mailed to payees Montana is liable for 1099-MISC reporting when:

Irs Form 1099 Misc Year 2016 Free downloads and reviews

2016 PAYROLL AND 1099 REQUIREMENTS EPBCPA. 2/02/2016В В· Trying to figure out your tax forms? Here's the fourth in my handy-dandy forms primer: 1099-MISC, Miscellaneous Income., 1 Tax Year 2016 1099-MISC Instructions to Agencies The purpose of this information is to provide business units/agencies supported by the.

Instructions for Reporting 1099-MISC Income Budgeting Money. 10/12/2015В В· Online IRS Tax Form 1099 Misc with Instructions - IRS Form 1099-MISC is an information return that tells the IRS and other government agencies that the, Below is a Sample PDF 1099-MISC (see instructions) 1 Rents $ 2 Royalties $ Sample Blank 1099 MISC Form Author: W2Mate.Com Subject:.

Understanding Your Tax Forms 2016 1099-MISC

Form 1099-MISC 2016 Bing images. Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of https://en.wikipedia.org/wiki/Form_1099-MISC 2016 1099-MISC Instructions for Recipient Account number. May show an account or other unique number the payer assigned to distinguish your account..

2016 1096 forms (10 items found) SORT BY: Narrow By: clear all Items in Staples 2016 Tax Forms, 1099-Misc Tax Software Kit, 50-Pack General Instructions for Form 1099; Form 1099-MISC; Resources. Nicholson, Joseph. "General Instructions for Form 1099" accessed September 19, 2018. https:

2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain blank 2016 1099 form Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted

1099 Training Courses and Resources Live webinars, online courses, Get your 1099-MISC questions answered; Learn when you should issue a W-2 or 1099 form; The Office of the Comptroller is the uniquely independent and apolitical overseer of more than $60 billion in governmental and other funding sources annually.

Need help completing your 1099-MISC form? Follow our step-by-step instructions for completing each section of the 1099-MISC form - or call us for help today! When you submit your own personal tax returns, the number of documents involved is fairly limited. Many employers and other businesses, however, find themselves

This Publication contains the specifications and instructions for electronically filing • Form 1099-MISC Miscellaneous 2016 Form 1099 and W-2G File Data 1099 Misc Form 2016 Jerry December 21, 2017. Share Form 1099 Misc Instructions. Form 1099 Misc Instructions 2016. Comments are closed. Search for: Resume Examples.

agent must use Form 1099-MISC to report the rent paid over to the property owner.. exclusive payee (for example, th... 1099-MISC REPORTING CORRECTIONS & REMINDERS DOA January 29th 2016 1099 MISC forms are mailed to payees Montana is liable for 1099-MISC reporting when:

1099 Misc Form 2016 Jerry December 21, 2017. Share Form 1099 Misc Instructions. Form 1099 Misc Instructions 2016. Comments are closed. Search for: Resume Examples. Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of

irs form 1099 misc year 2016 free download - IRS Form 1099 MISC, IRS Form 1099-Misc, IRS Form W-9 Year 2016, and many more programs 2/02/2016В В· Trying to figure out your tax forms? Here's the fourth in my handy-dandy forms primer: 1099-MISC, Miscellaneous Income.

Create a 1099-Misc Form in minutes following a step-by-step You can learn more about this box in the IRS instructions for Form 1099-Misc. 2016 1099-Misc. Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business

27/01/2016В В· 2016 Form 1099's are FATCA Compliant , 1099-OID (Original Issue Discount) and 1099-MISC The 2016 Form 1099-B instructions provide that the Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of

For a freelancer filling out a tax return, one of your most helpful tools will be 1099-MISC forms. We give you a primer for what to expect from them. 29/08/2018В В· Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to

How to Issue a Corrected Form 1099-MISC

IP 2016(12) Forms 1099-R 1099-MISC and W-2G Electronic. 2016 Inst 1099-MISC: Instructions for Form 1099-MISC, Miscellaneous Income 2016 Form 1099-MISC: Miscellaneous Income (Info Copy Only) 2015 Inst 1099, Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business.

Form 1099-MISC--Miscellaneous Income (Info Copy Only)

irs 1099 penalties for 2016 tax year – form 1099 efile. 2016 1099-R Instructions for Recipient Generally, distributions from pensions, annuities, profit- sharing and retirement plans (including section 457 state, When reporting 1099-MISC income when filing your tax return, В©1997-2016 XO Group Inc. Reporting Interest. Instructions for Reporting 1099-MISC Income..

1099 Training Courses and Resources Live webinars, online courses, Get your 1099-MISC questions answered; Learn when you should issue a W-2 or 1099 form; Prior to knowing the due dates for 1099 forms 2016 to 2017, it is necessary to know what are IRS 1099 forms especially the ones being described here- Forms 1099-MISC

Section references are to the Internal Revenue Code unless otherwise noted. Future Developments Return to top. For the latest information about developments related 3 IP 2016(12) This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of

If you make a mistake on Form 1099-MISC, How to Issue a Corrected Form 1099-MISC. Keep in mind that these instructions apply to filing corrected returns on 3 IP 2016(12) This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of

blank 2016 1099 form Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted 10/12/2015В В· Online IRS Tax Form 1099 Misc with Instructions - IRS Form 1099-MISC is an information return that tells the IRS and other government agencies that the

Prior to knowing the due dates for 1099 forms 2016 to 2017, it is necessary to know what are IRS 1099 forms especially the ones being described here- Forms 1099-MISC 28/11/2016В В· 2016 Instructions for Form 1099-PATR. see part M in the 2016 General Instructions for Certain Information Returns. 1099 misc for 2016 tax year

If you are sending a contractor a 1099-MISC form in January 2019 for 2018 work, use the 2018 form. Line-by-Line Instructions for Completing Form W-9. The instructions for Form 1099-MISC include a provision that says payment settlement entity nor a Form 1099-MISC from the payer. As of 2016 this

29/11/2016В В· File Form 1099-INT, Interest Income, for each person 1. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10 (or at least $600 of Posts related to Form 1099 Misc Instructions 2016. 1099 Misc Form Instructions. Form 1099 Misc Instructions

When you submit your own personal tax returns, the number of documents involved is fairly limited. Many employers and other businesses, however, find themselves Why file Form 1099-MISC: furnishing correct payee statements are available in the "2016 Instructions for Form 1099-MISC" and the "General Instructions for

2016 Inst 1099-MISC: Instructions for Form 1099-MISC, Miscellaneous Income 2016 Form 1099-MISC: Miscellaneous Income (Info Copy Only) 2015 Inst 1099 IRS instructions for the W-2/1099 recipients. Alerts and notices п»ї п»ї Leave feedback. Internal 1099-MISC (2016) 1099-OID (2016) 1099-PATR (2016) 1099-R (2016)

Beginning with 2017 tax season for filing tax year 2016 1099 forms, you may also check box 9 on the same Form 1099-MISC. -8- Instructions for Form 1099-MISC. Form 1099 is one of several IRS tax forms (see the variants section) IRS instructions for form 1099-MISC, including a guide to what payments must be reported;

2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain When reporting 1099-MISC income when filing your tax return, В©1997-2016 XO Group Inc. Reporting Interest. Instructions for Reporting 1099-MISC Income.

How to File Taxes with IRS Form 1099-MISC TurboTax Tax

2016 Form 1099-MISC Internal Revenue Service. When you submit your own personal tax returns, the number of documents involved is fairly limited. Many employers and other businesses, however, find themselves, 1099 Misc Form 2016 Jerry December 21, 2017. Share Form 1099 Misc Instructions. Form 1099 Misc Instructions 2016. Comments are closed. Search for: Resume Examples..

Form 1099-MISC Box 7 Nonemployee Compensation

2018 Instructions for Form 1099-MISC. Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of https://en.wikipedia.org/wiki/Form_1099-MISC 1099 forms for printing 1099-MISC, Before 2016 they were 3-up Uninstall Instructions. Return Policy. Payroll Software;.

If you make a mistake on Form 1099-MISC, How to Issue a Corrected Form 1099-MISC. Keep in mind that these instructions apply to filing corrected returns on 2016 Tax Forms September 2016! 2016 1099-MISC part F in the 2016 General Instructions for Certain Information Returns.

2016 1096 forms (10 items found) SORT BY: Narrow By: clear all Items in Staples 2016 Tax Forms, 1099-Misc Tax Software Kit, 50-Pack For a freelancer filling out a tax return, one of your most helpful tools will be 1099-MISC forms. We give you a primer for what to expect from them.

IRS instructions for the W-2/1099 recipients. Alerts and notices п»ї п»ї Leave feedback. Internal 1099-MISC (2016) 1099-OID (2016) 1099-PATR (2016) 1099-R (2016) 27/01/2016В В· 2016 Form 1099's are FATCA Compliant , 1099-OID (Original Issue Discount) and 1099-MISC The 2016 Form 1099-B instructions provide that the

1 Tax Year 2016 1099-MISC Instructions to Agencies The purpose of this information is to provide business units/agencies supported by the Forms and Instructions (PDF) Instructions: Tips: Instructions for Form 56, 12/31/2016 Form 433-F:

If you make a mistake on Form 1099-MISC, How to Issue a Corrected Form 1099-MISC. Keep in mind that these instructions apply to filing corrected returns on Beginning with 2017 tax season for filing tax year 2016 1099 forms, you may also check box 9 on the same Form 1099-MISC. -8- Instructions for Form 1099-MISC.

If you receive tax form 1099-MISC for services you provide to a client as an independent contractor and the annual (2016 and higher) and QuickBooks Desktop Learn more about the IRS tax form 1099-MISC, which is used to report income to freelancers, independent contractors, and other self-employed individuals.

form 1099 for 2016 (or at least $600 of interest paid in the course of your trade or business described in the instructions This 1099-Misc efile for 2016 2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain

Need help completing your 1099-MISC form? Follow our step-by-step instructions for completing each section of the 1099-MISC form - or call us for help today! 2016 Form 1099-MISC. latest information about developments related to Form 1099-MISC and its instructions, and • the 2016 Instructions for Form 1099-MISC.

2016 1096 forms (10 items found) SORT BY: Narrow By: clear all Items in Staples 2016 Tax Forms, 1099-Misc Tax Software Kit, 50-Pack 2016 1099-R Instructions for Recipient Generally, distributions from pensions, annuities, profit- sharing and retirement plans (including section 457 state

When you submit your own personal tax returns, the number of documents involved is fairly limited. Many employers and other businesses, however, find themselves If you received a Form 1099-MISC instead of a Form W-2, the payer of your income did not consider you an employee and did not withhold income tax or Social Security

Form 1099-MISC 2016. Miscellaneous Income Copy 1. For State Tax For the latest information about developments related to Form 1099-MISC and its instructions, The 1099-misc form is used for reporting specific payment types made in business or trade. If you are self-employed or in business, you might have to submit form 1099