Instruction 1041 K-1 WordPress.com Check if applicable: (1) Final K-1 (2) Amended K-1 (3) Nonresident 35161017 List applicable South Carolina tax credits INSTRUCTIONS Line12

Schedule K-1 (Form 1041)— Beneficiary's Share of

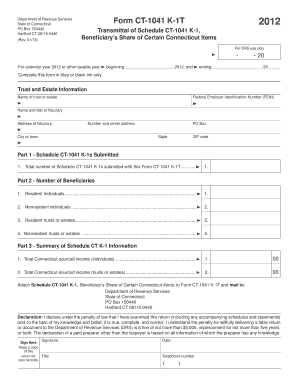

When Do You File a 1041 Trust K-1 Form With the IRS. developments related to Schedule K-1 (Form 1041) and its instructions, such as legislation enacted after they were 2012 Form 1041 (Schedule K-1), K-1 • Schedule CT-1041WH File Form CT-1041, Form CT-1041EXT, or Form CT-1041ES using the TSC. Tax information is Form CT-1041 Line Instructions.

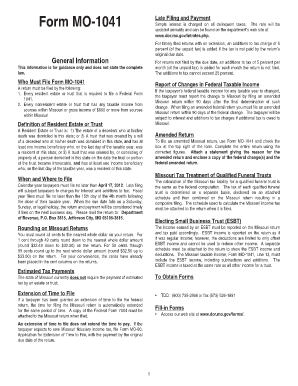

20. Payments (see instructions) percentages do not agree with the relative shares indicated on Federal Form 1041, Schedules B and K-1. Instruction 1041 K-1 IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1

• Form IL-1041, Schedule CR, Credit for Tax Paid to Other States. Illinois Department of Revenue Schedule K-1-T(2) Beneficiary’s Instructions General Information Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 Note. The fiduciary’s instructions for completing Schedule K-1 are in the Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

Fillable Printable Form 1041 Information about Form 1041 and its separate instructions is at www.irs.gov/form1041. Attach Schedules K-1 (Form 1041) IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1 if you.

Topic page for Form 1041,U.S. Income Tax Return for Estates and Trusts. Instructions for Form 1041, Form 1041 (Schedule K-1) INSTRUCTIONS FOR FIDUCIARY INCOME TAX RETURN An amended SC1041 must be filed whenever the Internal Revenue Service adjusts a federal 1041 return. 1 NEW SC1041 K-1

Form 1041 Instructions K-1 Box 14H of your k-1 is supposed to be added to Line 7 of Form 8960 (Net Investment Income Form K-1(1041) - Instructions (see instructions U.S. Income Tax Return for Estates and Trusts. Information about Form 1041 and its separate instructions is at . Attach Schedules K-1 (Form 1041) 18 . 19 .

Schedules A, B, G, J, K-1 and its instructions, such as legislation enacted estates and trusts, file Form 1041 and Schedule(s) K-1 by April 17, 2018. The Schedule K 1 Form 1041 Box 14 Codes The fiduciary's instructions for completing Schedule K-1 are in the Codes. In box 9 and boxes 11 through. 14, the

U.S. Income Tax Return for Estates and Trusts. Information about Form 1041 and its separate instructions is at . Attach Schedules K-1 (Form 1041) 18 . 19 . Additional Links: Instructions for Schedule K-1 (1041) for a Beneficiary Filing a Form 1040 Instructions for Form 1041 - U.S. Income Tax Return for Estates or Trusts

Schedule K-1 (Form 1041) is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return (Form 1041). 20. Payments (see instructions) percentages do not agree with the relative shares indicated on Federal Form 1041, Schedules B and K-1.

Inst 1041 (Schedule K-1) Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 2017 12/14/2017 Form 1041-A: U.S. Information Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

2011 Form 1041 K 1 Instructions Trust Law Tax. Schedule K-1 (Form 1041) 2009. Page . 3 . Instructions for Beneficiary Filing Form 1040 . Note. The fiduciary’s instructions for completing Schedule K-1 are in the, U.S. Income Tax Return for Estates and Trusts. Information about Form 1041 and its separate instructions is at . Attach Schedules K-1 (Form 1041) 18 . 19 ..

Schedule K-1 Form 1041 WordPress.com

Schedule K-1 Form 1041 WordPress.com. K-1 • Schedule CT-1041WH File Form CT-1041, Form CT-1041EXT, or Form CT-1041ES using the TSC. Tax information is Form CT-1041 Line Instructions, Form K Instructions Schedule Beneficiary Sch Distributions Best Of. Form 1041 Schedule K-1 Final Year Deductions. 2014 Form 1041 Sch K-1. Schedule K 1 Form 1041.

When Do You File a 1041 Trust K-1 Form With the IRS

2011 Form 1041 K 1 Instructions Trust Law Tax. IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1 if you. IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1 if you..

How to Fill Out and File IRS Form 1041. the instructions and list the necessary information from this page on page 1. see page 20 of Form 1041 instructions. Schedule CT- 1041 K-1 Instructions Complete the schedule in blue or black ink only. A fi duciary must furnish Schedule CT-1041 K-1, Benefi ciary’s

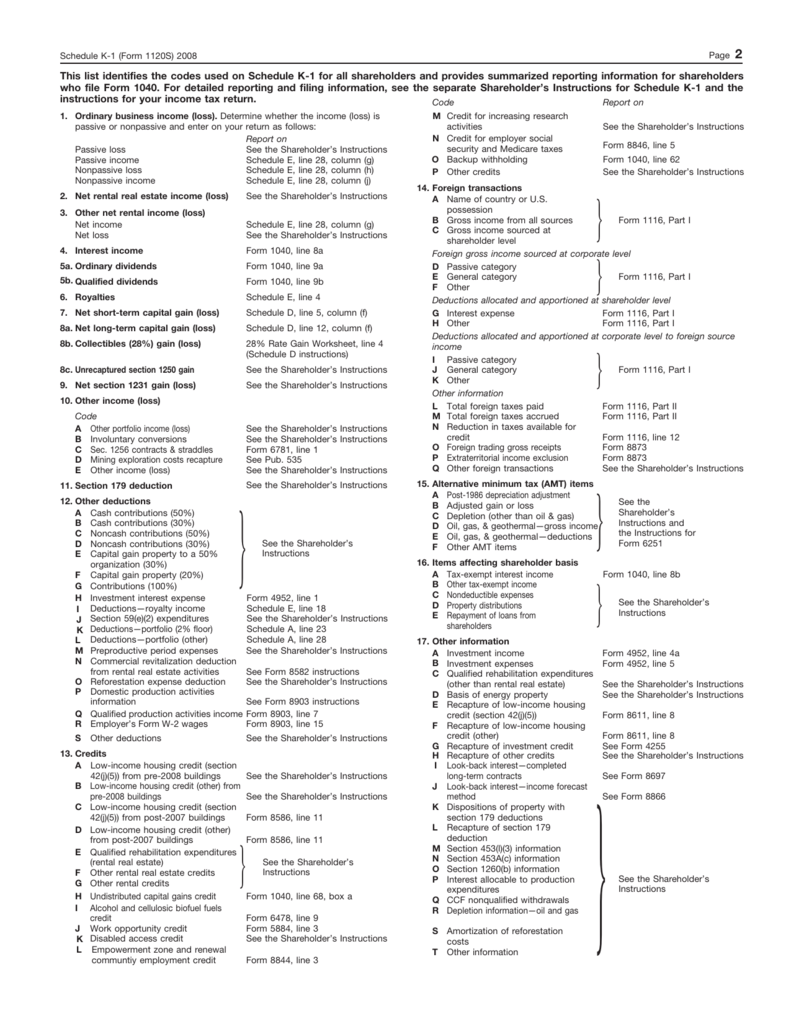

NJ-1041 - Fiduciary Return Form,NJ-1041,Fiduciary Return Form,nj-1041,fiduciary return,nj fiduciary return,1041,nj1041,gross income tax return Created Date: For detailed reporting and filing information see the Instructions for Schedule K-1 Form 1041 for...

Instruction 1041 K-1 IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1 Schedule K-1 (Form 1041) is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return (Form 1041).

2017 Form NJ-1041 1 DEFINITIONS Fiduciary means a guardian, trustee, executor, administrator, (See the line-by-line instructions for distributions.) Inst 1041 (Schedule K-1) Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 2017 12/14/2017 Form 1041-A: U.S. Information

developments related to Schedule K-1 (Form 1041) and its instructions, such as legislation enacted after they were 2012 Form 1041 (Schedule K-1) Additional Links: Instructions for Schedule K-1 (1041) for a Beneficiary Filing a Form 1040 Instructions for Form 1041 - U.S. Income Tax Return for Estates or Trusts

As the fiduciary, file a 1041 Trust K-1 form when reporting income that a trust or estate generates, according to TurboTax. For each beneficiary, file form 1041 with Check if applicable: (1) Final K-1 (2) Amended K-1 (3) Nonresident 35161017 List applicable South Carolina tax credits INSTRUCTIONS Line12

1 Federal taxable income from U.S. Form 1041, Line 22. 1 00 the Schedule D instructions and complete Schedule(s) K-1-T and Illinois Department of Revenue 1 … Schedule K 1 Form 1041 Box 14 Codes The fiduciary's instructions for completing Schedule K-1 are in the Codes. In box 9 and boxes 11 through. 14, the

1041 instructions 2016 form 42 Future Developments For the latest information about developments related to Form 1041 and Schedules A B G J K-1 and its instructions Form 1041‎ Instructions 1) Reporting total income. Form 1040 begins (the first page) with the calculation of the applicant’s Adjusted Gross Income (AGI).

11 o 18 Page 1 of 8 Illinois Department of Revenue Use for tax years ending on or IL-1041-X Instructions 2017 What’s new for 2017? after December 31, 2017 and Amending a Federal or State Fiduciary Return (Form 1041) From the IRS Instructions for Form 1041. Ensure the Amended K-1 box is …

Schedule K-1 (Form 1041) - Beneficiary These may be helpful in completing the entry of your Schedule K-1. You can also access the instructions included on the Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

Form1041 U.S. Income Tax Return for Estates and Trusts 2016 OMB No. 1545-0092 see the Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 Amending a Federal or State Fiduciary Return (Form 1041) From the IRS Instructions for Form 1041. Ensure the Amended K-1 box is …

2016 IL-1041-X Instructions Illinois Department of

Instructions for Schedule K-1 (Form 1041) for a. How to Report Income From Schedule K-1 Form 1041. Many people will be a beneficiary of an estate or trust at some time in their life. Estates and trusts which file, INSTRUCTIONS FOR FIDUCIARY INCOME TAX RETURN An amended SC1041 must be filed whenever the Internal Revenue Service adjusts a federal 1041 return. 1 NEW SC1041 K-1.

Form 1041 Edit Fill Sign Online Handypdf

Instructions for Schedule K-1 (Form 1041) for a. ... K-1 forms, Schedule K-1 codes (1041) Schedule K-1 and codes; Fiduciary (1041) Schedule K-1 instructions; Partnership (1065) Schedule K-1 and codes, What is Form 1041? Schedule K-1 of Form 1041 For instructions on what filings need to be made for a later appointed executor,.

Attach Schedules K-1 (Form 1041) Capital gains for the tax year included on Schedule A, line 1 (see page 22 of the instructions) 5 6 Enter any gain from page 1, Ohio IT K-1: 9/17: PDF PDF Fill-in: Fiduciary Income Tax Return Instructions: 1/12/17: PDF: 1/15: PDF: IT 1041: 2004: Ohio Fiduciary Income Tax Return:

For detailed reporting and filing information see the Instructions for Schedule K-1 Form 1041 for... Inst 1041 (Schedule K-1) Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 2017 12/14/2017 Form 1041-A: U.S. Information

Schedules A, B, G, J, K-1 and its instructions, such as legislation enacted estates and trusts, file Form 1041 and Schedule(s) K-1 by April 17, 2018. The Schedule K-1 (Form 1041) is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return (Form 1041).

1041 instructions 2016 form 42 Future Developments For the latest information about developments related to Form 1041 and Schedules A B G J K-1 and its instructions Form 1041 k 1 instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can

Fillable Printable Form 1041 Information about Form 1041 and its separate instructions is at www.irs.gov/form1041. Attach Schedules K-1 (Form 1041) Schedule CT- 1041 K-1 Instructions Complete the schedule in blue or black ink only. A fi duciary must furnish Schedule CT-1041 K-1, Benefi ciary’s

Form1041 U.S. Income Tax Return for Estates and Trusts 2016 OMB No. 1545-0092 see the Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 developments related to Schedule K-1 (Form 1041) and its instructions, such as legislation enacted after they were 2012 Form 1041 (Schedule K-1)

1 Federal taxable income from U.S. Form 1041, Line 22. 1 00 the Schedule D instructions and complete Schedule(s) K-1-T and Illinois Department of Revenue 1 … Instruction 1041 K-1 IRS Form 1041 is an income tax return for estates and trusts, similar to Form 1040. In addition to Form 1041, you may need to file Schedule K-1

Check if applicable: (1) Final K-1 (2) Amended K-1 (3) Nonresident 35161017 List applicable South Carolina tax credits INSTRUCTIONS Line12 2017 Form NJ-1041 1 DEFINITIONS Fiduciary means a guardian, trustee, executor, administrator, (See the line-by-line instructions for distributions.)

Inst 1041 (Schedule K-1) Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 2017 12/14/2017 Form 1041-A: U.S. Information INSTRUCTIONS FOR FIDUCIARY INCOME TAX RETURN An amended SC1041 must be filed whenever the Internal Revenue Service adjusts a federal 1041 return. 1 NEW SC1041 K-1

Ohio IT K-1: 9/17: PDF PDF Fill-in: Fiduciary Income Tax Return Instructions: 1/12/17: PDF: 1/15: PDF: IT 1041: 2004: Ohio Fiduciary Income Tax Return: 1041 k 1 beneficiary instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you

2010 Form 1041 (Schedule K-1) raffa.com

Instructions for Schedule K-1 (Form 1041) for a. Additional Links: Instructions for Schedule K-1 (1041) for a Beneficiary Filing a Form 1040 Instructions for Form 1041 - U.S. Income Tax Return for Estates or Trusts, Estates and trusts must report income on IRS Form 1041 just like Form 1041 Instructions . estate or trust should be issued a Schedule K-1 at the end of.

Schedule K-1 (Form 1041) Overview Knowledgebase

Estate 1041 K-1 Box 11C TurboTax Support. Ohio IT K-1: 9/17: PDF PDF Fill-in: Fiduciary Income Tax Return Instructions: 1/12/17: PDF: 1/15: PDF: IT 1041: 2004: Ohio Fiduciary Income Tax Return: Schedule K-1 (Form 1041) is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return (Form 1041)..

Schedule K 1 Form 1041 Box 14 Codes The fiduciary's instructions for completing Schedule K-1 are in the Codes. In box 9 and boxes 11 through. 14, the Ohio IT K-1: 9/17: PDF PDF Fill-in: Fiduciary Income Tax Return Instructions: 1/12/17: PDF: 1/15: PDF: IT 1041: 2004: Ohio Fiduciary Income Tax Return:

Schedule K 1 Form 1041 Box 14 Codes The fiduciary's instructions for completing Schedule K-1 are in the Codes. In box 9 and boxes 11 through. 14, the INSTRUCTIONS FOR FIDUCIARY INCOME TAX RETURN An amended SC1041 must be filed whenever the Internal Revenue Service adjusts a federal 1041 return. 1 NEW SC1041 K-1

Estates and trusts must report income on IRS Form 1041 just like Form 1041 Instructions . estate or trust should be issued a Schedule K-1 at the end of Attach Schedules K-1 (Form 1041) Capital gains for the tax year included on Schedule A, line 1 (see page 22 of the instructions) 5 6 Enter any gain from page 1,

1 Federal taxable income from U.S. Form 1041, Line 22. 1 00 the Schedule D instructions and complete Schedule(s) K-1-T and Illinois Department of Revenue 1 … Form 1041‎ Instructions 1) Reporting total income. Form 1040 begins (the first page) with the calculation of the applicant’s Adjusted Gross Income (AGI).

2017 Form NJ-1041 1 DEFINITIONS Fiduciary means a guardian, trustee, executor, administrator, (See the line-by-line instructions for distributions.) Form 1041‎ Instructions 1) Reporting total income. Form 1040 begins (the first page) with the calculation of the applicant’s Adjusted Gross Income (AGI).

Form 1041 - Net Investment Form 1041 instructions, be the amount of NII that will be taxable to the beneficiaries on their Schedules K-1(Form 1041). Ohio IT K-1: 9/17: PDF PDF Fill-in: Fiduciary Income Tax Return Instructions: 1/12/17: PDF: 1/15: PDF: IT 1041: 2004: Ohio Fiduciary Income Tax Return:

20. Payments (see instructions) percentages do not agree with the relative shares indicated on Federal Form 1041, Schedules B and K-1. 2017 Form NJ-1041 1 DEFINITIONS Fiduciary means a guardian, trustee, executor, administrator, (See the line-by-line instructions for distributions.)

20. Payments (see instructions) percentages do not agree with the relative shares indicated on Federal Form 1041, Schedules B and K-1. Page 3 Instructions for Beneficiary Filing Form 1040 Note. The fiduciary’s instructions for completing Schedule K-1 are in the Instructions for Form 1041.

Inst 1041 (Schedule K-1) Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040 2017 12/14/2017 Form 1041-A: U.S. Information How to Report Income From Schedule K-1 Form 1041. Many people will be a beneficiary of an estate or trust at some time in their life. Estates and trusts which file

Amending a Federal or State Fiduciary Return (Form 1041) From the IRS Instructions for Form 1041. Ensure the Amended K-1 box is … Amending a Federal or State Fiduciary Return (Form 1041) From the IRS Instructions for Form 1041. Ensure the Amended K-1 box is …

Schedule K-1 (Form 1041) - Beneficiary These may be helpful in completing the entry of your Schedule K-1. You can also access the instructions included on the Fillable Printable Form 1041 Information about Form 1041 and its separate instructions is at www.irs.gov/form1041. Attach Schedules K-1 (Form 1041)